Intensive care management of coronavirus disease 2019 (COVID-19): challenges and recommendations - The Lancet Respiratory Medicine

Evolving epidemiology and transmission dynamics of coronavirus disease 2019 outside Hubei province, China: a descriptive and modelling study - The Lancet Infectious Diseases

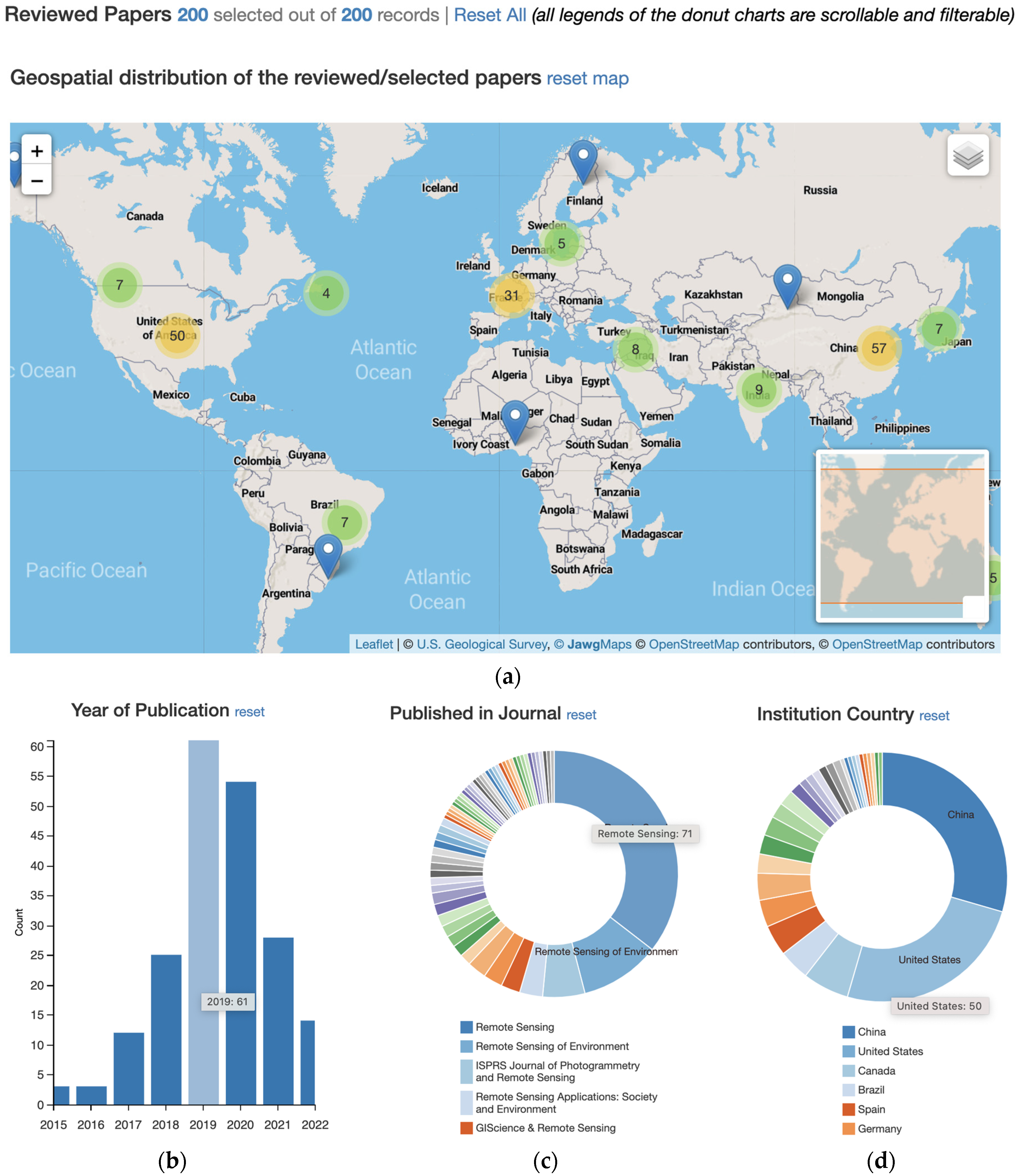

Remote Sensing | Free Full-Text | Google Earth Engine and Artificial Intelligence (AI): A Comprehensive Review

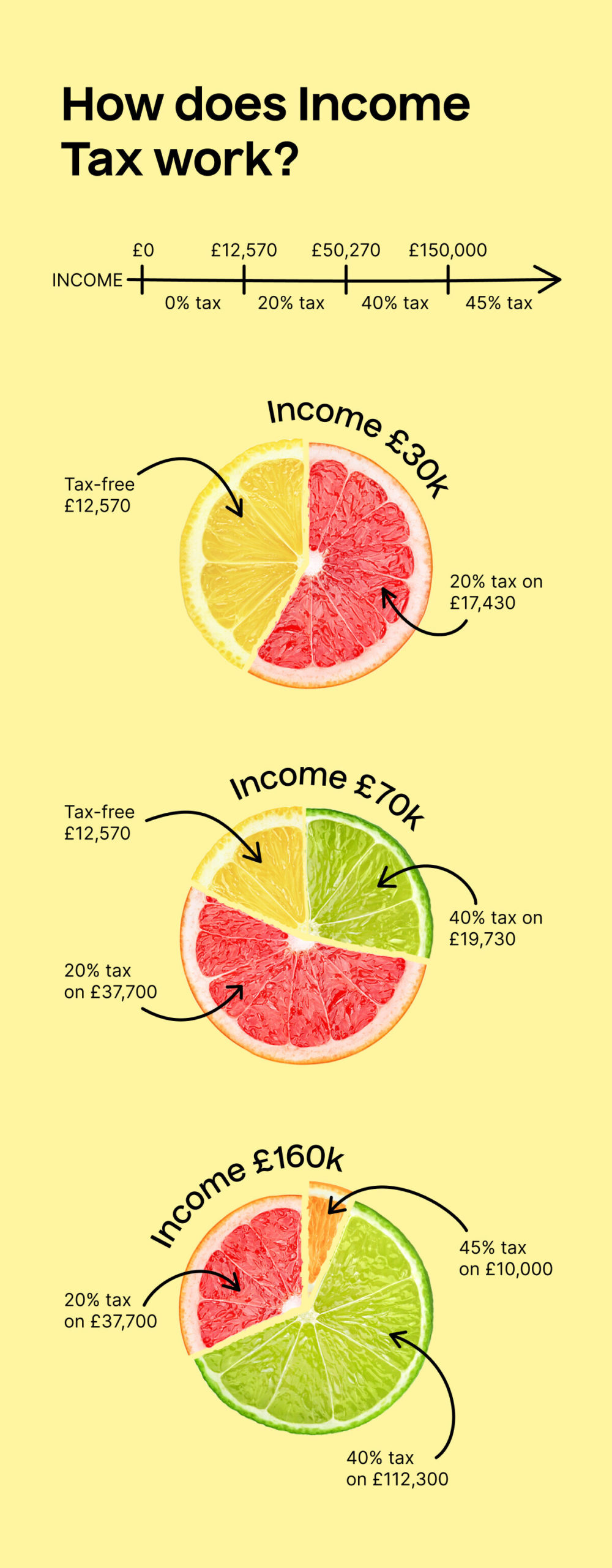

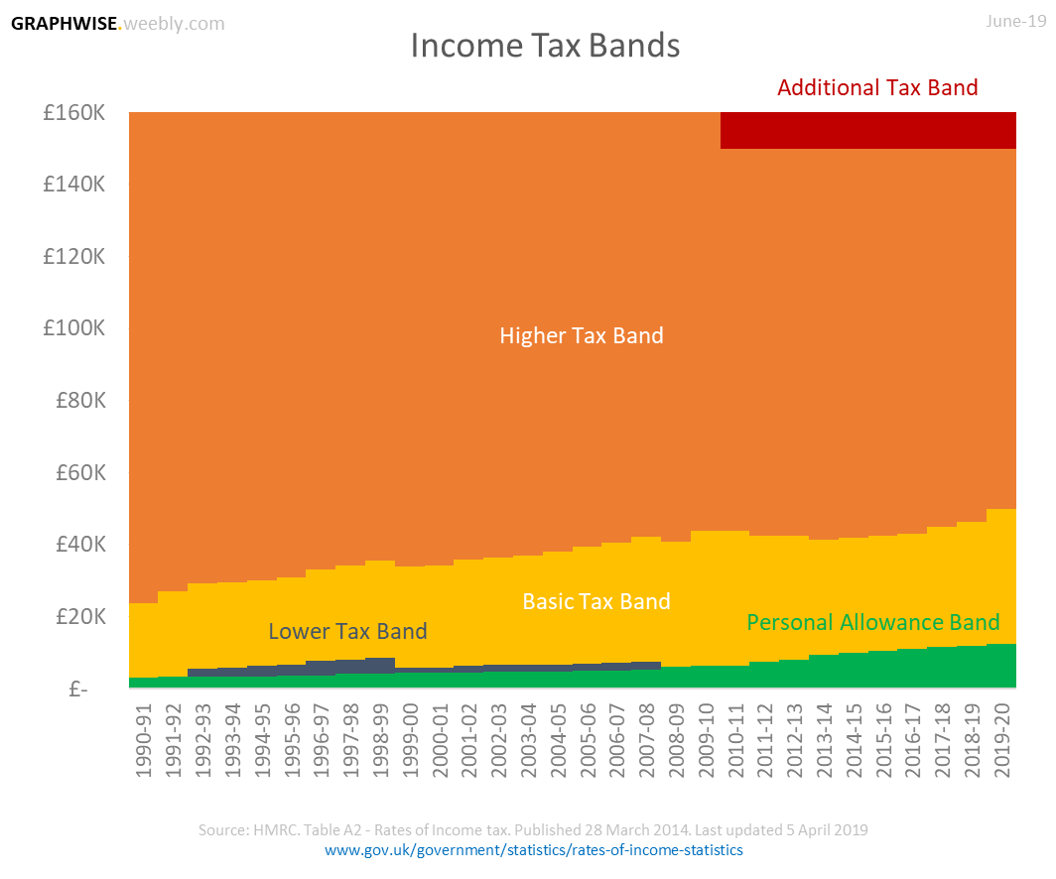

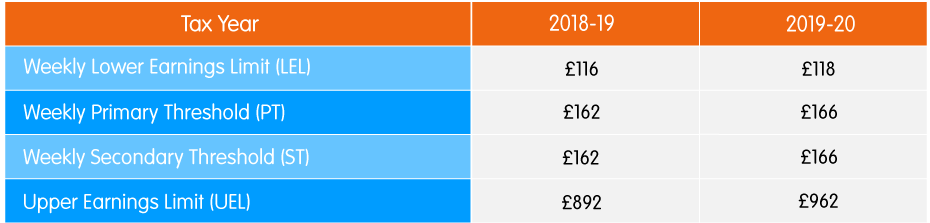

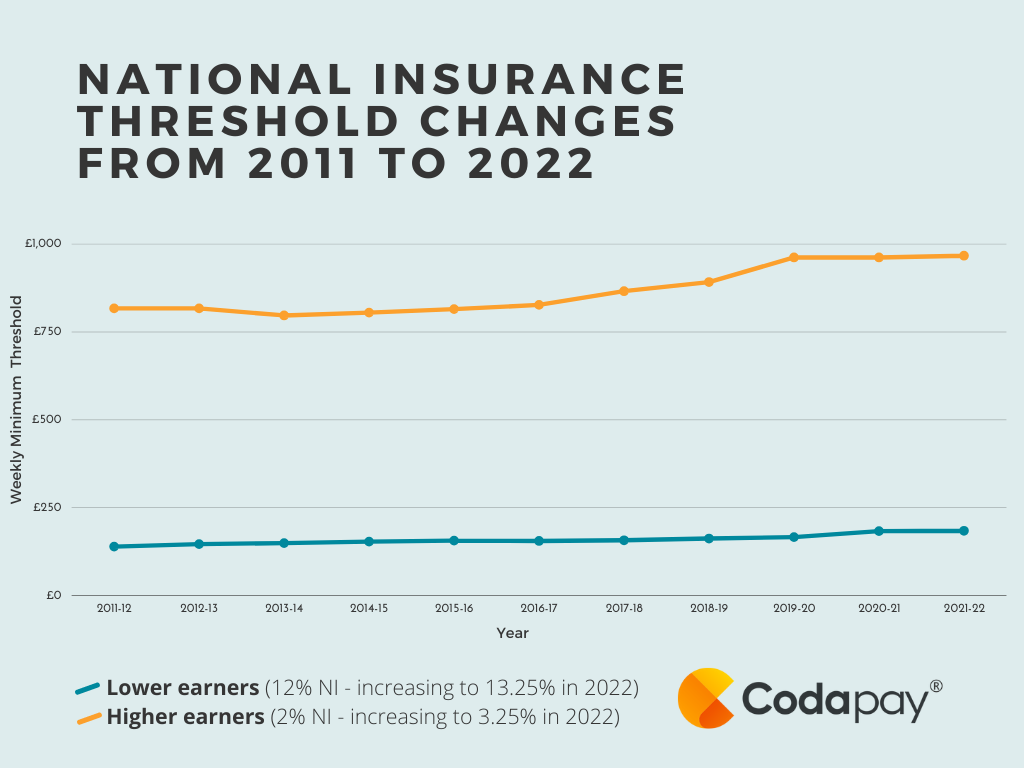

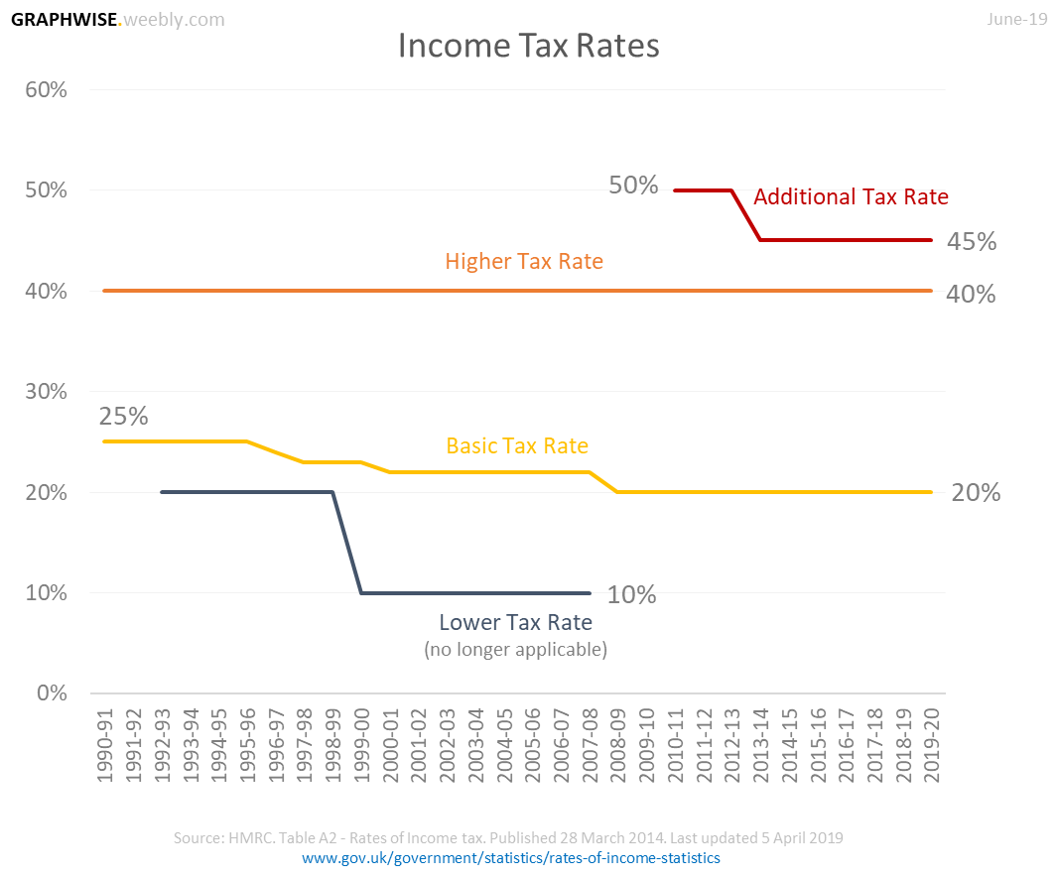

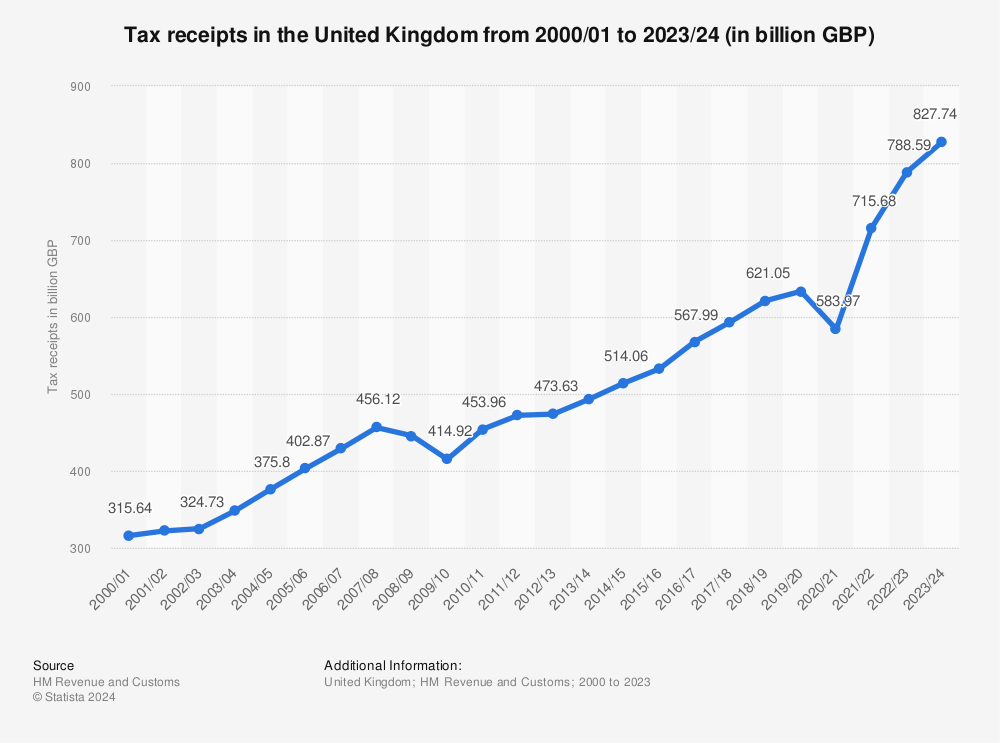

Penalising the poor: HMRC charged 400,000 with penalties when they had no tax to pay – Tax Policy Associates Ltd

Penalising the poor: HMRC charged 400,000 with penalties when they had no tax to pay – Tax Policy Associates Ltd