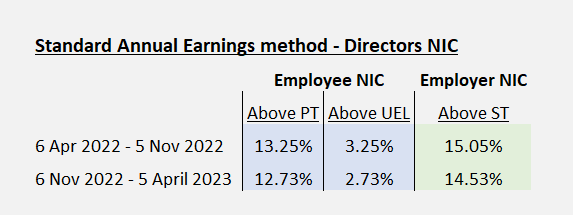

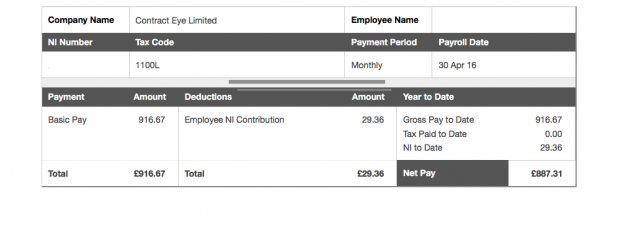

The Most Tax Efficient Salary for Limited Company Directors in 2022/23 - JSM Partners | Award Winning Chartered Tax Advisors & Accountants

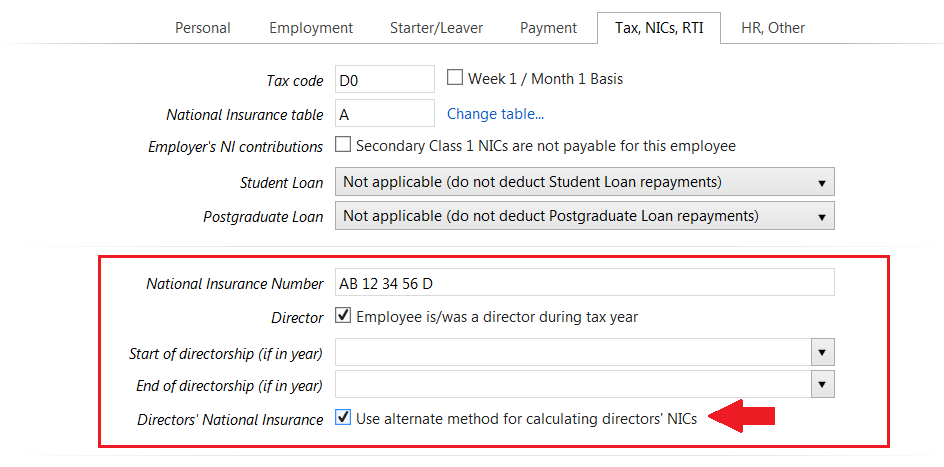

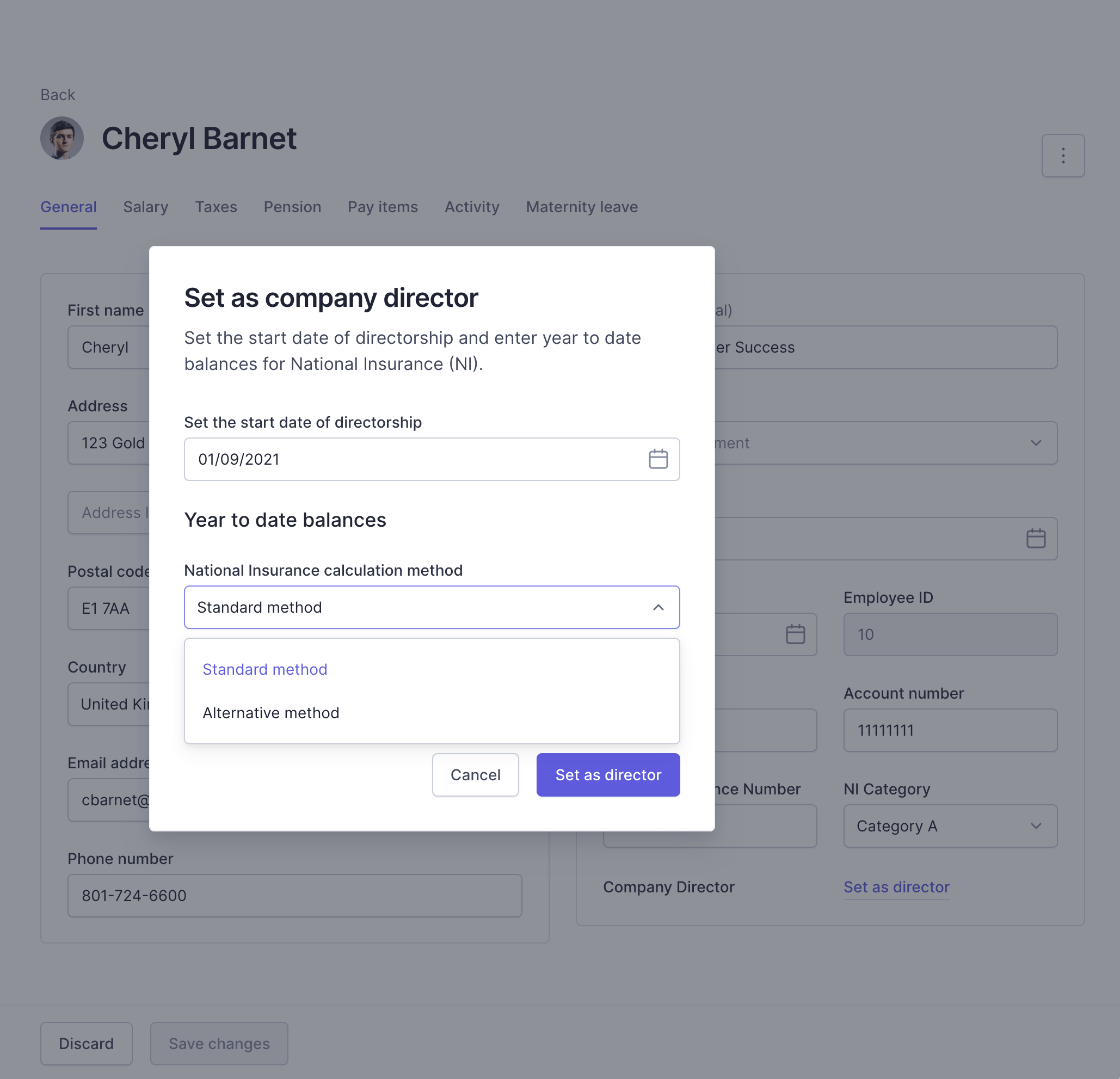

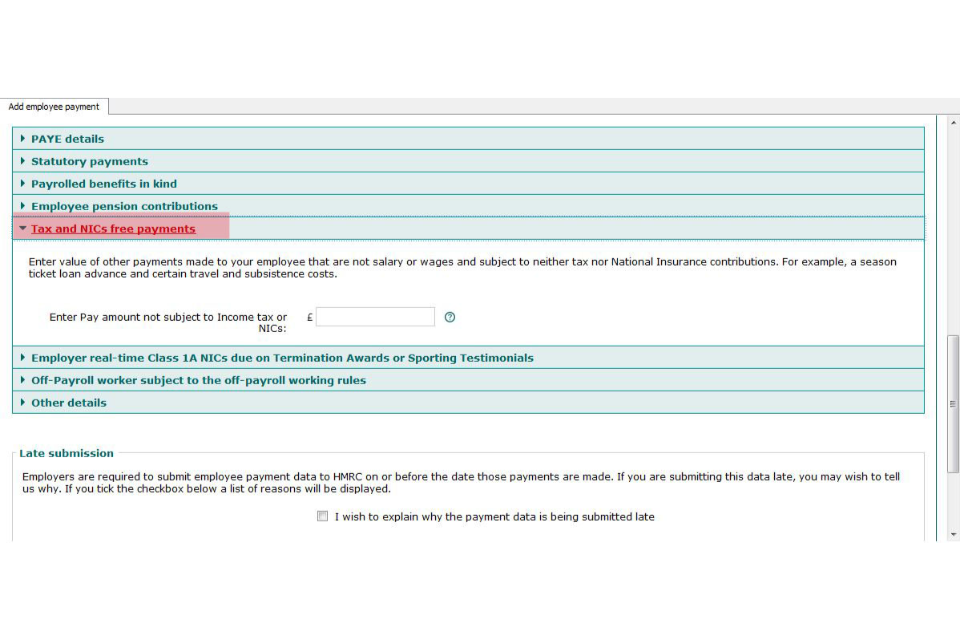

How to select the National Insurance contribution basis in a limited company director's payroll profile – FreeAgent